Picture this: You’ve discovered an irresistible opportunity in the vibrant Miami real estate market—a pre-construction condo that promises great potential. The flexibility and potential for higher returns make it an attractive option for savvy investors. We covered the benefits of investing in Pre-Construction in Miami in our previous article. But when it comes to the final payment, a question arises: Should you pay with cash or explore the world of financing? Let BlokHaus be your guide as we explore the key benefits of both options.

Benefits of Financing

Benefit 1: Increased IRR with Financing—Do the Math!

One of the standout advantages of financing a pre-construction condo is the potential for a higher Internal Rate of Return (IRR). By leveraging the bank’s money, you can magnify your investment returns. Let’s break it down with an example:

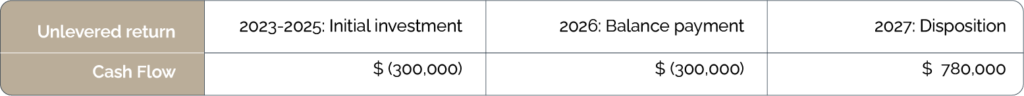

Imagine you secure a pre-construction condo in the esteemed 600 Miami World Center at Miami Downtown for a total price of $600,000. After making advance payments totaling $300,000 throughout the construction stages, you have a balance payment of $300,000 due in Q3 2026 when construction is complete. Let’s assume the property appreciates by 30% by 2027, and you decide to sell it. The selling price is a remarkable $780,000.

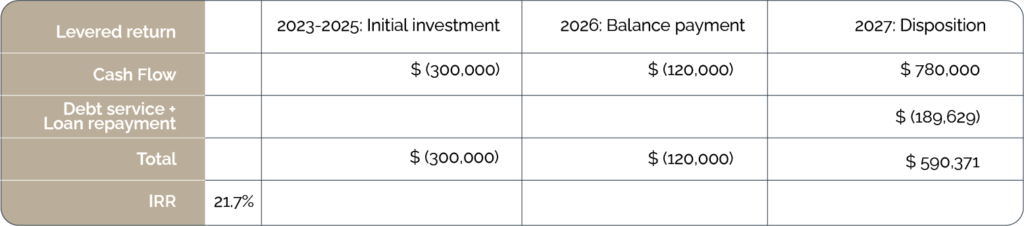

Now, let’s delve into the numbers when utilizing financing. Suppose you opt for a loan at 6.5% interest with a loan-to-value (LTV) ratio of 60%, taking out a $180,000 loan and providing a down payment of $120,000. Considering a one-year period, your debt service amounts to $11,640 annually, with a loan balance of $177,988. When factoring these elements in, your cash flow would appear as follows:

For simplicity, this example omits additional expenses, tax considerations, fees, and potential rental income. However, even with these simplified calculations, the financing scenario offers an IRR of 21.7% compared to an 18.8% return in a cash transaction. Numbers don’t lie—financing can unlock a higher IRR potential! Another important factor to consider is the potential affordability of financing when the Federal Reserve (Fed) has not increased interest rates in June’s meeting. In such circumstances, mortgage rates are expected to decrease by the end of 2023, creating more opportunities for investors.

Benefit 2: Enhanced Cash Flow—A Flowing Fountain of Financial Flexibility

Financing brings another enticing perk: enhanced cash flow. By spreading the cost of the property over an extended period, you can collect rental income or savor personal use of the condo while covering mortgage payments, maintenance fees, and other expenses. This positive cash flow provides flexibility—funds that can be reinvested or directed towards other ventures, fueling your financial aspirations.

Benefit 3: Preservation of Liquidity—Your Ace in the Real Estate Game

Buying with financing preserves your liquidity, giving you the freedom to allocate capital across various investment opportunities. By retaining cash, you can seize other lucrative ventures, diversify your portfolio, or handle unexpected financial needs. In a rapidly evolving real estate market, having liquid assets at your disposal becomes a valuable resource.

Benefit 4: Tax Benefits—A Little Sweetness for Your Finances

Financing pre-construction condos can also offer tax advantages. Mortgage interest and property taxes are typically tax-deductible, reducing your overall tax liability. These deductions can offset the costs associated with owning the property and contribute to your overall financial gains—a pleasant bonus!

But When Does Cash Reign Supreme?

While financing brings forth a plethora of benefits, there are situations where purchasing a pre-construction condo with cash holds more allure:

Benefit 1: Negotiating Power—Cash is King!

Cash buyers hold a powerful trump card: the ability to negotiate more favorable terms and potentially secure a lower purchase price. Sellers often favor cash offers, as they eliminate the risk of financing falling through. With cash in hand, you position yourself as a strong and attractive buyer, ready to seize the opportunity

Benefit 2: Avoiding Interest Costs

Purchasing with cash eliminates the need to pay interest on a loan, increasing the overall return on your investment. This approach is suitable for investors with substantial cash reserves who prioritize reducing long-term expenses.

Financing a pre-construction condo presents numerous benefits, including higher IRR, enhanced cash flow, preservation of liquidity, and tax advantages. Leveraging a loan can maximize returns and unlock long-term wealth accumulation. However, there are situations where a cash purchase may be more preferable, such as gaining negotiating power and avoiding interest costs. The decision ultimately depends on your financial goals, risk tolerance, and investment strategy.

At BlokHaus Real Estate + Investments, we excel at finding the best investment potential and helping you unlock smart investments in the thriving Miami real estate market. With dozens of carefully selected pre-construction projects on our website, we can assist you in securing the best high-potential new development project to build wealth.