Last month, Terra Group, a local developer, acquired a 15.5-acre waterfront parcel in Downtown Miami for a record-breaking $1.225 billion, highlighting the area’s high growth potential. This historic transaction marks the largest land acquisition in Florida. What does it mean for the real estate market? Keep reading to learn more about this transaction and how we at BlokHaus Real Estate + Investments think it will impact nearby properties in Miami.

Located at 1431 N Bayshore Drive, the 15.5-acre parcel between the MacArthur and Venetian causeways boasts over 800 feet of Biscayne Bay waterfront and could accommodate around 8,000 units. The site, which previously housed the Miami Herald headquarters, was acquired by Malaysian casino operator Genting for $235 million in 2011. Their initial plans for a $3 billion casino and resort ultimately fell through.

The monumental acquisition of the site in April 2022 for $1.225 billion raises intriguing questions about what might be developed in such a coveted location. David Martin, president of Terra Group, suggests that the grandeur of the site offers an opportunity to create something extraordinary, something that would make the residents of Miami beam with pride. “Our team is now focused on understanding the full potential of the property and the surrounding area. As we learn more, our vision for this site will evolve,” Martin noted in a press release statement on NBC Miami.

In real estate development, land cost significantly contributes to the total asset value. The Urban Land Institute reported that land costs constituted 25% of total residential development project costs. Commercial real estate varies, but CBRE found land costs accounted for 25-30% of total commercial office development costs in major U.S. cities.

Other previous records of high land acquisition transactions include the following:

Citadel, a prominent enterprise that announced its relocation to Florida in 2022, procured a 2.5-acre tract at 1201 Brickell Bay Drive for $363 million. Led by CEO Ken Griffin, Citadel plans to erect an office tower on Brickell Bay. Interestingly, the site’s previous owner, Florida East Coast Realty, purchased the land nearly 22 years prior for $15.5 million, intending to develop a twin-towered skyscraper replete with 660 ultra-luxury residences, a pedestrian plaza, and a host of shops, restaurants, and art galleries.

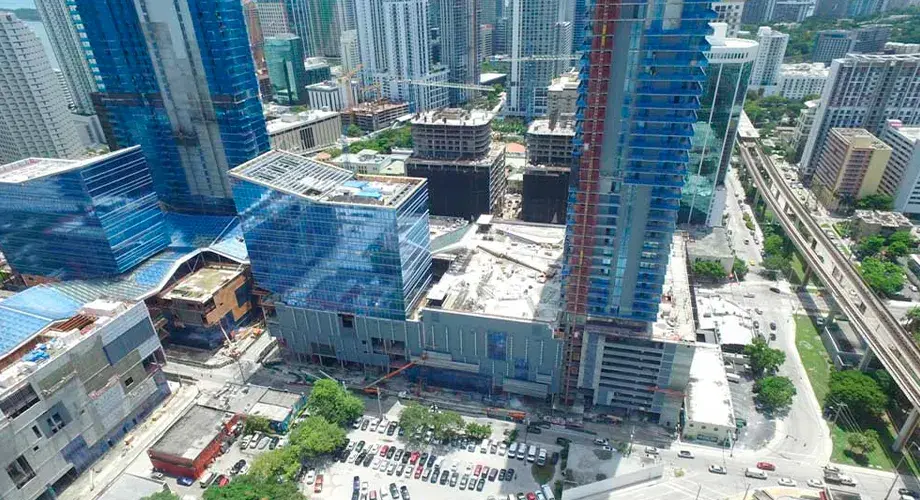

The Miami Worldcenter signifies the second-largest deal. Between 2011 and 2014, Art Falcone, Nitin Motwani, and Marc Roberts collectively acquired over 27 acres in Downtown Miami, amounting to $350 million. This ambitious, large-scale mixed-use development stands as one of the city’s most significant projects. Currently, the new pre-construction project of 600 Miami World Center is on the market featuring 579 fully furnished and finished luxury residences. This impressive 32-story building, located in the booming Downtown area of Miami, offers a splendid investment opportunity. With no rental restrictions, these condos provide a perfect chance to capitalize on Miami’s growing real estate market. Don’t miss out – condos are available for sale now.

Brickell City Centre represents another noteworthy acquisition in Miami. In 2011, Swire Properties invested $200 million in a 9.1-acre mixed-use development site. Situated in the Brickell Financial District, this expansive property accommodates retail, office, and residential spaces.

In 2015, The Trump Group secured The Estates at Acqualina in Sunny Isles Beach for $159 million. This development comprises two 50-story luxury residential towers, offering breathtaking oceanfront views.

OKO Group and Cain International purchased a 1-acre site in the Brickell Financial District for $125 million in 2017. Known as 830 Brickell, this site is earmarked for a future 57-story office tower.

Lastly, in 2012, Fort Capital Management and the LeFrak Organization obtained the 8.7-acre site of the erstwhile Surf Club in Miami Beach for $116 million, known today as The Surf Club Four Seasons. The developers have transformed the site into a luxury residential complex, complete with a Four Seasons hotel, private residences, and an exclusive club.

Land acquisitions often lead to major developments, significantly impacting neighborhoods and property values. In recent years, developers in Miami are actively pursuing mixed-use properties that combine residential and commercial components, including cafes, restaurants, and retail shops. These modern development projects prioritize the inclusion of a wide range of amenities, making the area more appealing to businesses and customers alike. As a result, rental prices increase, generating higher income for investors. This positive trend encourages developers to further introduce high-end properties and build infrastructure around them to meet the growing demand. Collectively, these investments contribute to an elevated standard of living and an increase in the overall value of the properties in the area.

Terra’s recent purchase of the land plot by Biscayne Bay signals the high potential for value growth in the neighborhoods like Downtown and Edgewater.

Miami Edgewater is a thriving neighborhood that holds the potential to become a local equivalent of New York City’s prestigious Park Avenue. With its waterfront location, convenient transportation access, and ongoing modern development projects, Edgewater offers a promising environment for property price appreciation. The future development of the $1.225 billion site in Edgewater will have a positive impact on neighboring projects such as Edition, Villa Miami and Aria Reserve, further enhancing the appeal of the area.

Miami Downtown has also witnessed substantial growth in recent years, with numerous noteworthy residential developments taking place. The commercial property sector is thriving, with rental prices nearing those seen in Manhattan. The residential projects in the area cater to affluent individuals who have chosen to relocate to Miami for work, drawn by the city’s exceptional infrastructure and delightful climate.

Exciting pre-construction projects like Casa Bella, 600 MWC, and West Eleventh are well-positioned to benefit from the anticipated development of the new land asset by the Terra Group, further contributing to the attractiveness of the area.

At BlokHaus Real Estate + Investments, we specialize in investment analysis and are dedicated to identifying properties with high appreciation and return potential for investors. Our team of experts offers tailored solutions to match your investment objectives. Explore our website to discover our extensive listings and comprehensive services.